I’m doing an AMA in the Science Fiction reddit today. Stop by and ask me anything about my writing, past or future books, technology, etc! I’ll be checking in periodically throughout the day.

Category Archives: miscellaneous

Counterbalancing Trump

A few days ago a friend mentioned they were subscribing to The New York Times to help ensure we’d continue to benefit from real journalism, and because the NYT has been repeatedly singled out by Trump. That started me thinking about places to either spend or donate to counter the abuses we’ll see under Trump. After some consideration, here’s what I’ve done.

- News: Trump suppresses news sources that disagree with him. More than ever, it is important to support newspapers with actual investigative journalism. I subscribed to The New York Times and The Washington Post.

- Civil Liberties: I donated to the ACLU, who has defended gay marriage, voting, reproductive rights, and a slew of other important liberties for the last hundred years.

- Hate Crimes: I donated to the SPLC, which tracks hate crime and hate groups across the US.

- Digital Rights: The US has never had a more pervasive surveillance state than it does right now. Trump has demonstrated that he’ll do and support anything to get what he wants, including threatening to imprison his political opponents, attack independent news sources, use torture, etc. We can be virtually guaranteed that he will include extensive use of the surveillance apparatus to spy on people. I donated to the EFF, which fights to protect digital rights, including privacy and our access to strong encryption.

- Women’s Health: Trump and Pence will go after women’s rights and access to healthcare. I donated to Planned Parenthood.

- Black Lives Matter: I donated to Black Lives Matter. There are many other groups of people who are discriminated against, but the epidemic of violence against black people is particularly bad and has to stop. I was particularly encouraged to see that the Black Lives Matter organization is working with the indigenous people at Standing Rock. Organizations, governments, and businesses that abuse or ignore the rights and wellbeing of one group will do the same to other groups and to the environment. Groups working together to support each other sets a great example.

It’s not easy for everyone to afford to make a donation. In my case, I’m choosing to make donations in lieu of buying gifts for family this holiday season. (Merry Christmas to my mom, dad, brother, and partner!)

I hope you will consider making donations to one or more of these organizations or contributing in some other way.

Cortes Island fight to save forest

If you’ve read The Turing Exception, you know that part of it is set on Cortes Island, in British Columbia. I first visited Cortes in 2003, and learned then about a long-running effort to save a forest on the island from clear cutting. That forest is now a public park. I’m honored to have met Ruth and Oliver. Here’s the story: Long fight to save a beloved British Columbia forest ends with victory.

Ruth Ozeki stands in front of new public park. Photo by Oliver Kellhammer.

Don’t Feed the 1%

Lately it seems like the 99% / 1% debate on income inequality has faded from active discussion. Snowden and gun violence and other topics have temporarily taken over our consciousness. But the issue of the accumulation of ever greater wealth by the 1% hasn’t disappeared, as I was recently reminded by the number of friends who are unemployed or underemployed.

For the last week I’ve been thinking about locus of control. Another day I’ll come back to this topic as it applies to publishing, which was where my thinking about it originated. But these ruminations made me consider how it might apply to wealth inequality.

So much of the debate about the 99% seemed to assume our locus of control is external: that is, we the 99% are the victims of the 1% who control the economy. The wealthy own the big corporations, the banks, and the political system, and frankly it seems like they hold all the chips.

However, the irony in this is that we continue to feed the 1% our money, every day. We all make decisions and take actions that put more and more of our hard earned money directly into the pockets of the 1%. This is within our control. We can change our behaviors so that more of our money remains with the 99%.

Can this eliminate wealth inequality? I don’t think so. But it could stem the tide, slow the flow of ever increasing amounts of income, wealth, and other resources into the pockets of the 1%.

The trick is to spot where and how money flows to the 1%.

Here’s how:

Buy goods made by people, not corporations

Every time you buy a product, you are supporting the people who made that product. If you buy a children’s toy, your dollars go to the workers who built it with their manual labor, the manager of those workers, the boss of those managers, and so on.

For the most part, this is good: your money is providing a living for other people. This is what we want.

If the product is manufactured by a corporation, then some percentage of the company’s revenue goes to those employees, but some goes to the executives and owners or investors in a company. (In the case of a publicly held company, either directly through dividends or indirectly through boosting the share price of the company.)

For large companies, these executives, owners, and investors are nearly always going to be the 1%. The average CEO salary in 2012 was $9.7 million. The “top one percent of households have 35% of all privately held stock, 64.4% of financial securities, and 62.4% of business equity“.

When a manufactured good is made by a major corporation, I don’t know what percent of the profit from that product goes to the employees (the 99%) versus the executives and investors (the 1%), but let’s take a guess, and say that the very wealthy get 20% and everyone else gets 80%.

|

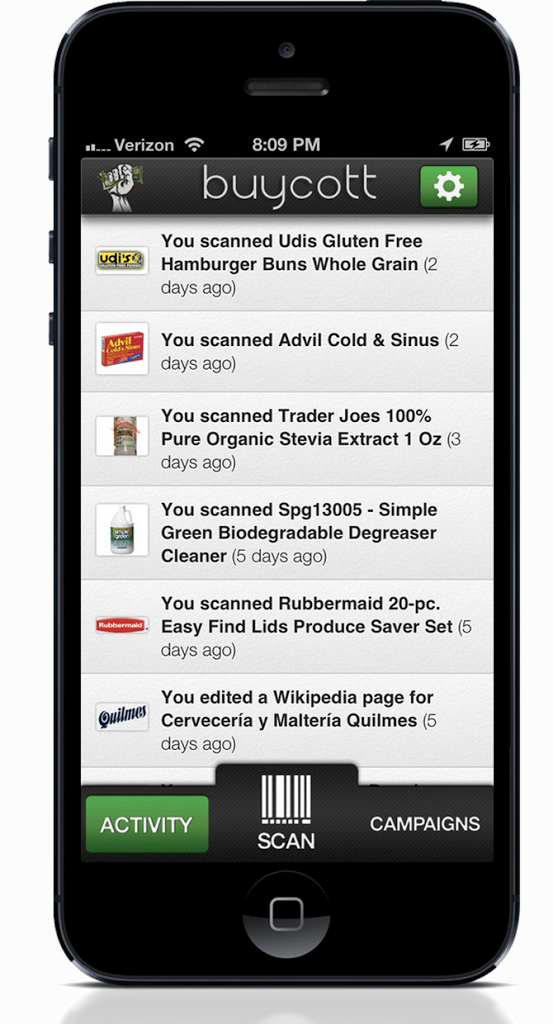

| Buycott helps identify who manufactures a given product |

By comparison, think about buying a small scale product. This could be a hand-manufactured good on Etsy or something made by a small, privately owned company. In this case, your money still goes to the workers who made the product and their managers and even the company owner. But nearly always, in this case, we’re still talking about the 99%. (Most small business owners make a modest income.) In this case, we’re still supporting our fellow citizens, but we’re giving them 100% of our purchase and avoiding the 20% that would otherwise go to the 1%.

(Again, this 80/20 is just a guess. If anyone has more accurate numbers, please post them in the comments with sources, and I’ll update the article.)

There’s a great app called Buycott that helps identify where products are made by scanning their barcodes. It also identifies whether the company is involved in any campaigns (e.g. human rights abuses, independent farming, etc.) and whether the product helps or harms that campaign.

OK, enough about products. Let’s move onto retailers.

Buy from locally owned stores, not national chains

Where you buy something is just as important as what you buy. Profit margins vary by industries, but anywhere from 20% to 60% of the money you spend flows to the retailer itself (the store), rather than the manufacturer of the product. That is, if you spend $50 on kid’s clothing, the store makes $25 and $25 goes to the manufacturer.

The employees of a retail store are all surely part of the 99%. These are the people we want to support, no matter what.

In the case of any national chain, there will be high level executives, owners and investors that are part of the 1%. Again, these 1% will benefit disproportionately from people buying from the stores. Let’s say that again, they take 20% of the money you spend, leaving 80% for the employees.

| Supportland rewards shoppers at local business |

Compare this to an individually owned store, or even a small, local chain of stores. In this case, the owner may be the person behind the cash register. They are certainly not part of the 1%. Even for a small chain, while the owners might make a good income, they’re still far more likely to be like you and me. And most likely, any profits earned by the company are being spent right in your local area, flowing back to the community.

In Portland, we have a wonderful organization called Supportland that offers a rewards card for locally owned businesses. They help verify which companies truly are locally owned.

Buy with cash, not bank cards

We’ve covered what you buy and where you buy it. Now let’s consider how you buy goods. Most of us use credit or debit cards. Yet both credit and debit cards come with a hidden tax to the retailer: anywhere from 2% to 6% of your purchase price will flow to some combination of banks and card payment processors.

I first thought about this impact at a small, local food grocery. They put up a sign asking customers to pay in cash when possible, explaining the costs of credit and debit card processing. They pointed out that nearly the fees on bank card purchases came to nearly 5%. Groceries operate on fairly slim margins. Let’s say that for each dollar you spend at a grocery, 80 cents goes to pay for the food (e.g. to the manufacturer, farmer, distributor, etc.), and the grocer themselves earns 20 cents.

If card processing fees takes 5% of every dollar you spend, it reduces the amount earned by the grocery significantly: They go from earning 20 cents of every dollar to 15 cents, a 25% reduction.

The grocer pointed out that the amount they’d spend on credit card processing fees in the previous year would have been enough to provide every employee with full healthcare.

Bank locally and/or with credit unions

It’s the big financial institutions that have been behind so much of the excess of the last decade. Not only can we deny our profits to them, but we can also deny our capital to them.

Credit unions are non-profit banks. They don’t have publicly held stock and I’m guessing their executives are more modestly paid. I don’t know much about local banking, but I’m assuming there are still smaller, regional banks.

If you have a home mortgage or other loan, most of the money you pay each money is interest on the loan. That interest is profit for the bank, which, if it is a large financial institution, will flow into the pockets of the rich. If that same loan was held by a credit union or a local bank, the profits will remain within the bank or within the community.

If you have deposits with a bank, that is capital that can be used by the bank to make loans and investments. Do you want those loans and investments to be made in your local community? Then bank locally.

Spend less money & stay out of debt

Perhaps the simplest method to deny money to the 1% is to spend less money. Each dollar not spent is a dollar in your pocket, not theirs.

| How to Manage Your Money When You Don’t Have Any |

This isn’t easy. We’re accustomed to the life we have, and habits are hard to change. One great book I read recently that addresses change habits to align with our values is How to Manage Your Money When You Don’t Have Any by Erik Wecks.

Personally, I like the philosophy of borrowing and lending with friends and neighbors. Do we all need our own lawn mowers or can several neighbors share one? Can we give a friend a lift to the airport? Or invite folks over for a potluck instead of eating out? Give our kids old toys to someone expecting a new baby? There are so many ways we can share that saves us money even as it helps us build relationships with each other.

Avoid debt as well. It’s not just good for you, but consider that every dollar you have in debt is a tax on your entire financial life, and that tax goes directly to big banks.

What’s the net impact of making these changes?

I’ve made some rough estimates. I’ve assumed, for example, that in big corporations, about 80% of their revenue flows to employees, and 20% enriches the already wealthy. I’d guess that financial institutions might have a higher ratio of revenue that flows to the wealthy compared to other businesses. Usually an inaccurate estimate is better than none.

A quick spreadsheet estimated that shopping at national chains buying mass marketing goods with your credit card causes $215 out of every $1,000 (21.5%) to flow into the pockets of the wealthiest people.

But whether that actual number is 5%, 10%, or 30%, there’s something interesting that happens when we consider how money moves through the economy.

Recall that the money we spend does benefit the people who sell, make, and support goods. When I spend $1,000, the percent not taken by the wealthy goes into the pockets of other people in the 99%. Those people also spend that money, and some portion of what they spend goes to the 99%, and some goes to the 1%.

The economy depends on money recirculating. In fact, the very idea behind an economic stimulus (part of overall monetary policy) such as lowering taxes or offering a tax rebate is not just that you’ll spend money, but that the money you spend is earned by other people who then turn around and spend it again, and so forth.

Where we run into a problem is when the wealthy skim off a percentage of all transactions, as we see that they do through card processing fees and the ownership of retailers and manufacturers.

Consider the following chart. Each row assumes a different percentage that the 99% retain each time money is spent, ranging from 75% to 99.9%. In the first row, we see that the first time money is spent, $750 flows to other people in the 99%, while $250 flows to the wealthy. By the time that money has recirculated five times, only $237 is left for the 99%, while the wealthy now have most of it.

Compare this with the bottom row, in which we assume that through making very educating spending decisions, we’re almost always able to support small, local businesses and individuals. In that case, by the time the money has recirculated five times, an amazing $995 is still within the 99%, and only $5 has gone to the wealthiest 1%.

| Amount left for the 99% | ||||||

| Starting Amount | Percent Spent with the 99% | Round 1 | Round 2 | Round 3 | Round 4 | Round 5 |

| $1,000 | 75% | $750 | $563 | $422 | $316 | $237 |

| 80% | $800 | $640 | $512 | $410 | $328 | |

| 85% | $850 | $723 | $614 | $522 | $444 | |

| 90% | $900 | $810 | $729 | $656 | $590 | |

| 95% | $950 | $903 | $857 | $815 | $774 | |

| 99% | $990 | $980 | $970 | $961 | $951 | |

| 99.90% | $999 | $998 | $997 | $996 | $995 | |

Conclusions

Kickstarter Success Stories

If you’re considering a Kickstarter project, then it’s important to look at other projects to see what creates the conditions for a successful project. Two great resources are posts by Craig Mod, who funded a book project, and Jason Brubaker, who funded a graphic novel.

Both are excellent posts about what makes a project successful. Just a few highlights include:

- Reaching out to your network, via social media, email, blog, and more. Having a following ahead of time really helps, as does having an opt-in email mailing list for your blog. Just as important is arranging press coverage (social media or traditional). In other words, you need a marketing plan associated with your kickstarter project.

- A good video that plays to your highlights. Both blog posts shared tips.

- Make sure people know who you are. They aren’t just backing a project, they are backing a person who is doing the project. They need to feel confident that you’ll use the money wisely.

- Give thought to pledge levels. Don’t make them complicated, but do use the levels where people tend to contribute (usually $25, $50, $100, $250, $500)

- Kickstarter projects tend to have high initial contributions, then lull, then are high again near the end. Expect this, and plan to build early momentum. If you don’t get substantial contributions in the first few days, don’t expect to make it up later.

The Brother IntelliFax 2800 App Store

Via Design Mediates Life.

SQL Recipe: Calculating Ratios of Things

Let’s say we have an sql table of jobs. They can be in any of several states. They have a starte time and a completed time. And they have have a type of A or B.

| type | started | completed | state |

|---|---|---|---|

| A | 9:01am | 9:02am | completed |

| A | 9:10am | 9:14am | aborted |

| B | 9:20am | 9:21am | cancelled |

| A | 9:20am | 9:22am | completed |

Here’s a query that will calculate the ratio of completed jobs by type:

select type,

avg(cast(

case

when state='completed' then 1

else 0

end

as float)

) as completed_ratio

from jobs

group by type

The way it works:

- The case statement sets of value of 1 for the success condition, and 0 for any other.

- These are integers, so we cast them as float, so we’ll get the averaging behavior we want.

- We avg them, to get the average.

select type,

avg(cast(

case

when datediff(minute, completed, started) < 3 then 1

else 0

end

as float)

) as completed_ratio

from jobs

group by type

Federal Taxpayer Receipt

Amazing! See where your budget dollars go.

Allocating Stock in a Startup

I just read About Stock, a really useful article on allocating and distributing stock in a startup.

The article covers how many shares to issue, founders stock, setting aside stock for investors or options, what to do when you add employees later or a founder leaves, and capitol structure after an investment.

I found this bit of wisdom to be useful:

One way to deal with that (and it’s something an investor is likely to insist on) is that all founder stock purchases will be subject to a buy-back provision (part of the stock purchase agreement between each founder and the company). Basically this means that the founders do purchase and own their stock, and can vote the stock. But if the founder leaves the company (by either their choice or the company’s choice) in some period of time (4 years is typical) then the company has the right to purchase back some percentage of the stock at the same price the founder paid for it.

For example, let’s say a founder owns 20% of the company, and the company’s buy-back provision states that 20% of each founders holdings are not subject to buy-back, but for the first year after the purchase, 80% of a founder’s shares are subject to buy-back, for the second year, 60% is subject to buy-back, the third year, 40% is subject to buy-back, and the fourth year, 20% is subject to buy-back. After a full four years, there would be, in this example, no buy-back right remaining. This is basically a 4 year “vesting”, but it’s actually a declining buy-back right, as opposed to a vesting.

So what does that mean? Let’s say that founder left the company after 6 months. Under that arrangement described above, he or she retains the 20% of the original 20% ownership (i.e., 4% of the company) because that “vested” up front. The company has the right to buy-back the remaining 80% of that founders 20% ownership (i.e., the company buys-back a 16% share in the company). So the founder ends up owning 4% of the company.

10 Tips for Amazon to get the best quality, lowest prices, and free shipping.

Amazon.com is an amazing online retailer that sells far more than just the books and CDs it was once famous for. Now you can shop for anything you could imagine, from computers to food, clothing to furniture.

But there are certain tricks that experienced Amazon shoppers use to find the highest quality items, the best prices, and get free shipping. Without further ado, here they are.

- Sign up for Amazon Prime. Amazon Prime is Amazon’s free shipping program that gives you unlimited free two-day shipping. If you order from Amazon more than six times in a year, this can pay for itself in avoided shipping fees. And once you’re a Prime member, you’ll realize it’s cheaper and more convenient to order from Amazon than make a trip to the corner drugstore, even for routine items like band-aids and shampoo. You’ll save even more money on these every day items, and save the time and gas associated with trips to the store. Not everything sold on Amazon qualifies, because some stuff is sold by third parties. But in general, if it ships from an Amazon warehouse, it’ll ship for free. Prime costs $79/year.

- If you are a parent, check out Amazon Mom. This program gives you the same benefits as Amazon Prime, plus gives you 30% off diapers, all for no up-front charge.

- Choose quality products. With many thousands of products in each department, you want to find the best products within your price range. Thanks to product reviews by other shoppers, you can do this better on Amazon than in a store (are you going to believe a salesperson? or what it says on the box?). Here’s the process to use to find the highest quality items on Amazon.

- Do a search or choose a shopping category to get started. For example, I recently was looking for a “CD radio”

If you did a search, choose a department from the left hand column to enable sorting.

If you did a search, choose a department from the left hand column to enable sorting. - Usually you want the department with the highest volume of matches, or the ones most relevant to your search. The search results themselves show you how many matches exist in a given department. Note the “Electronics: See all 5,442 items” in the photo below.

- Once you’re in the right department, choose “Eligible for Amazon Prime” in the left hand column, or eligible for free super-saver shipping, if not a Prime member.

Also in the left hand column, choose Avg Customer Review of 4 Stars or more, the top line. With thousands of matching products, there’s no reason to look at items with less than a 4-star rating. Many products will have dozens or hundreds of reviews. To achieve a 3 star or lower rating, a product has to be pretty bad.

Also in the left hand column, choose Avg Customer Review of 4 Stars or more, the top line. With thousands of matching products, there’s no reason to look at items with less than a 4-star rating. Many products will have dozens or hundreds of reviews. To achieve a 3 star or lower rating, a product has to be pretty bad.- Now begin looking at the search results. You should have limited those results to high quality, free shipping items. It’s time to find the product that best matches the features you’re looking for. You shouldn’t pay for more product than you need. For example, I was looking for a CD player for my kid’s bedroom. I didn’t want to spent $75 or even $200 for a five year old’s radio. You can use the price limiters to set the price range you are willing to consider.

- Then look at the individual products, keeping three things in mind:

- A five star rating is meaningless if it is based on 1 or 2 reviews. Look at other products, and get an idea of how many reviews products in that category seem to have. If they have 50 or more reviews, then a product with only 1 or 2 reviews is suspect, even if those reviews are glowing. (Perhaps they are from the manufacturer themselves?)

- Look at the individual reviews to see what customers are saying, both positive and negative about the product. For example, I ended up a choosing a NAXA CD Radio. It was rated 4 stars, but virtually all of the negative reviews complained that the radio didn’t get loud enough. And that was pretty much the only complaint. Well, since I was choosing this for my kids room, and since I didn’t want them blasting their radio, that “negative” was actually a positive for me. It took a 4 star product and made it a 5 star product for me.

- If you can find something with 50 or more reviews and a 4.5 star or higher rating, you can be pretty confident that it is a great quality product you’ll be happy with.

- Buy groceries in bulk online: Amazon’s grocery store is like an online Costco, where you can get foods for about 10-20% less than you’d find them in the grocery store. This is great for items you eat on a regular basis, like cereal, bread, canned goods, and more. They have over 5,000 gluten-free items, more than 22,000 organic items.

- Use the Subscribe and Save

program to save an additional 15% on items you use all the time, like coffee, toilet paper, diapers, and so on. Plus, because the delivery of the items can be scheduled, you won’t run short and need to make a last minute run to the grocery store. Between the discounted prices and the Subscribe and Save program, you could be saving 25% or more on the items you use most often.

- Use the Amazon Credit Card

, and get 3% back on anything you buy from Amazon, 2% back at gas stations, restaurants, and drug stores, and 1% back on anything from any other retailer.

- If you don’t have Amazon Prime, and you need to spend just a little more money to qualify for free super-saver shipping, use filleritem to find inexpensive items to add to your shopping cart.

- Use the mobile apps, Amazon iPhone app

or Amazon iPhone app

to check out products when shopping at local retailers. You can use Amazon’s product reviews to see what other customers thought, and check to see if the price is cheaper online. And if you’re undecided on whether to buy it, you can put it in your Amazon shopping cart, and do more research later. Too often I’ve made impulse buys at local stores only to regret it later, thinking “if only I had researched it on Amazon first.” Now you can research products on the fly.

- Learn to Return

: It’s very easy to return products to Amazon. If an item doesn’t work, isn’t compatible, or isn’t what you ordered, Amazon will pay for return shipping. For anything else, you pay for shipping, but Amazon makes it easy by printing the shipping label for you, and just deducting the shipping costs from your credit. And “compatible” can be broadly interpreted. For example, I received a pan that didn’t fit in my dishwasher. To me, that meant it wasn’t compatible with my kitchen. So Amazon picked up the return shipping charge. I think it’s much easier to return something with Amazon than with a typical store. There’s no need to confront a manager, or wait in line at a return counter. Just go online, and 5 minutes later you’re done. Then drop off the package at any shipment location.

That’s it for the basic tips. You should be:

- Saving 3% across the board from the credit card.

- Saving 5-10% in free and reduced shipping charges.

- Saving 10-25% on groceries.

- Getting better quality products that last longer and give you more satisfaction.

- Saving time and money on items that become more convenient to purchase from Amazon than making a trip to chain drugstores and malls.

Advanced Tips:

Ready to go beyond the basic tips?

- Search for discounted products: You can search a given department to find only discount products. For example, if you wanted to look up discounted LCD TVs, you would go first to the LCD TV department

. Then go to the url bar in your browser, and add the text &pct-off=50- Hit return, and the page will refresh to show you only the TVs that are 50% off. You can replace 50 with whatever percent off you’d like to look for.

- Amazon Movers and Shakers

is an Amazon page that lists those products that are rapidly rising in sales rank. Frequently these are new products that are just starting to be sold on Amazon, but sometimes they can be products that have a deeply discounted price.