Lately it seems like the 99% / 1% debate on income inequality has faded from active discussion. Snowden and gun violence and other topics have temporarily taken over our consciousness. But the issue of the accumulation of ever greater wealth by the 1% hasn’t disappeared, as I was recently reminded by the number of friends who are unemployed or underemployed.

For the last week I’ve been thinking about locus of control. Another day I’ll come back to this topic as it applies to publishing, which was where my thinking about it originated. But these ruminations made me consider how it might apply to wealth inequality.

So much of the debate about the 99% seemed to assume our locus of control is external: that is, we the 99% are the victims of the 1% who control the economy. The wealthy own the big corporations, the banks, and the political system, and frankly it seems like they hold all the chips.

However, the irony in this is that we continue to feed the 1% our money, every day. We all make decisions and take actions that put more and more of our hard earned money directly into the pockets of the 1%. This is within our control. We can change our behaviors so that more of our money remains with the 99%.

Can this eliminate wealth inequality? I don’t think so. But it could stem the tide, slow the flow of ever increasing amounts of income, wealth, and other resources into the pockets of the 1%.

The trick is to spot where and how money flows to the 1%.

Here’s how:

Buy goods made by people, not corporations

Every time you buy a product, you are supporting the people who made that product. If you buy a children’s toy, your dollars go to the workers who built it with their manual labor, the manager of those workers, the boss of those managers, and so on.

For the most part, this is good: your money is providing a living for other people. This is what we want.

If the product is manufactured by a corporation, then some percentage of the company’s revenue goes to those employees, but some goes to the executives and owners or investors in a company. (In the case of a publicly held company, either directly through dividends or indirectly through boosting the share price of the company.)

For large companies, these executives, owners, and investors are nearly always going to be the 1%. The average CEO salary in 2012 was $9.7 million. The “top one percent of households have 35% of all privately held stock, 64.4% of financial securities, and 62.4% of business equity“.

When a manufactured good is made by a major corporation, I don’t know what percent of the profit from that product goes to the employees (the 99%) versus the executives and investors (the 1%), but let’s take a guess, and say that the very wealthy get 20% and everyone else gets 80%.

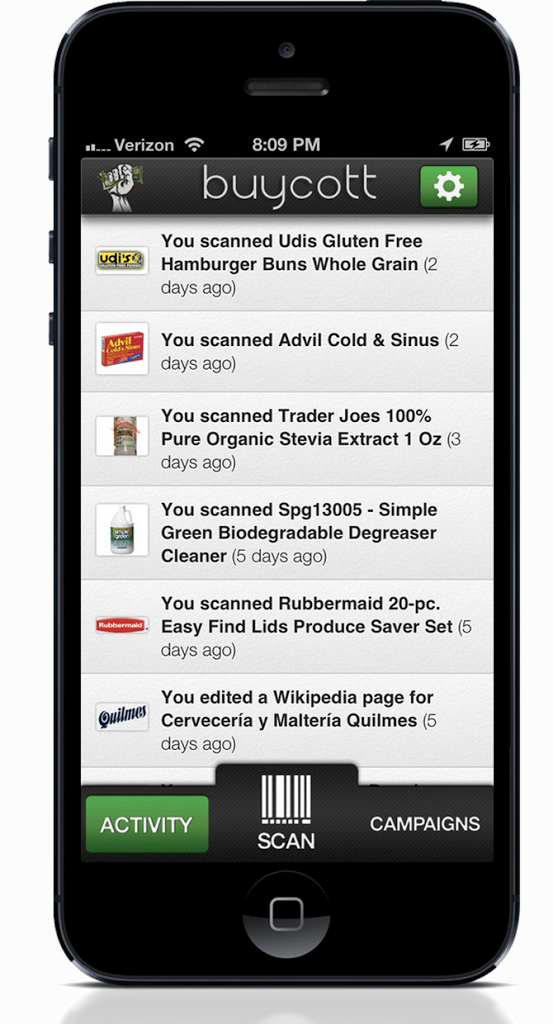

|

| Buycott helps identify who manufactures a given product |

By comparison, think about buying a small scale product. This could be a hand-manufactured good on Etsy or something made by a small, privately owned company. In this case, your money still goes to the workers who made the product and their managers and even the company owner. But nearly always, in this case, we’re still talking about the 99%. (Most small business owners make a modest income.) In this case, we’re still supporting our fellow citizens, but we’re giving them 100% of our purchase and avoiding the 20% that would otherwise go to the 1%.

(Again, this 80/20 is just a guess. If anyone has more accurate numbers, please post them in the comments with sources, and I’ll update the article.)

There’s a great app called Buycott that helps identify where products are made by scanning their barcodes. It also identifies whether the company is involved in any campaigns (e.g. human rights abuses, independent farming, etc.) and whether the product helps or harms that campaign.

OK, enough about products. Let’s move onto retailers.

Buy from locally owned stores, not national chains

Where you buy something is just as important as what you buy. Profit margins vary by industries, but anywhere from 20% to 60% of the money you spend flows to the retailer itself (the store), rather than the manufacturer of the product. That is, if you spend $50 on kid’s clothing, the store makes $25 and $25 goes to the manufacturer.

The employees of a retail store are all surely part of the 99%. These are the people we want to support, no matter what.

In the case of any national chain, there will be high level executives, owners and investors that are part of the 1%. Again, these 1% will benefit disproportionately from people buying from the stores. Let’s say that again, they take 20% of the money you spend, leaving 80% for the employees.

| Supportland rewards shoppers at local business |

Compare this to an individually owned store, or even a small, local chain of stores. In this case, the owner may be the person behind the cash register. They are certainly not part of the 1%. Even for a small chain, while the owners might make a good income, they’re still far more likely to be like you and me. And most likely, any profits earned by the company are being spent right in your local area, flowing back to the community.

In Portland, we have a wonderful organization called Supportland that offers a rewards card for locally owned businesses. They help verify which companies truly are locally owned.

Buy with cash, not bank cards

We’ve covered what you buy and where you buy it. Now let’s consider how you buy goods. Most of us use credit or debit cards. Yet both credit and debit cards come with a hidden tax to the retailer: anywhere from 2% to 6% of your purchase price will flow to some combination of banks and card payment processors.

I first thought about this impact at a small, local food grocery. They put up a sign asking customers to pay in cash when possible, explaining the costs of credit and debit card processing. They pointed out that nearly the fees on bank card purchases came to nearly 5%. Groceries operate on fairly slim margins. Let’s say that for each dollar you spend at a grocery, 80 cents goes to pay for the food (e.g. to the manufacturer, farmer, distributor, etc.), and the grocer themselves earns 20 cents.

If card processing fees takes 5% of every dollar you spend, it reduces the amount earned by the grocery significantly: They go from earning 20 cents of every dollar to 15 cents, a 25% reduction.

The grocer pointed out that the amount they’d spend on credit card processing fees in the previous year would have been enough to provide every employee with full healthcare.

Bank locally and/or with credit unions

It’s the big financial institutions that have been behind so much of the excess of the last decade. Not only can we deny our profits to them, but we can also deny our capital to them.

Credit unions are non-profit banks. They don’t have publicly held stock and I’m guessing their executives are more modestly paid. I don’t know much about local banking, but I’m assuming there are still smaller, regional banks.

If you have a home mortgage or other loan, most of the money you pay each money is interest on the loan. That interest is profit for the bank, which, if it is a large financial institution, will flow into the pockets of the rich. If that same loan was held by a credit union or a local bank, the profits will remain within the bank or within the community.

If you have deposits with a bank, that is capital that can be used by the bank to make loans and investments. Do you want those loans and investments to be made in your local community? Then bank locally.

Spend less money & stay out of debt

Perhaps the simplest method to deny money to the 1% is to spend less money. Each dollar not spent is a dollar in your pocket, not theirs.

| How to Manage Your Money When You Don’t Have Any |

This isn’t easy. We’re accustomed to the life we have, and habits are hard to change. One great book I read recently that addresses change habits to align with our values is How to Manage Your Money When You Don’t Have Any by Erik Wecks.

Personally, I like the philosophy of borrowing and lending with friends and neighbors. Do we all need our own lawn mowers or can several neighbors share one? Can we give a friend a lift to the airport? Or invite folks over for a potluck instead of eating out? Give our kids old toys to someone expecting a new baby? There are so many ways we can share that saves us money even as it helps us build relationships with each other.

Avoid debt as well. It’s not just good for you, but consider that every dollar you have in debt is a tax on your entire financial life, and that tax goes directly to big banks.

What’s the net impact of making these changes?

I’ve made some rough estimates. I’ve assumed, for example, that in big corporations, about 80% of their revenue flows to employees, and 20% enriches the already wealthy. I’d guess that financial institutions might have a higher ratio of revenue that flows to the wealthy compared to other businesses. Usually an inaccurate estimate is better than none.

A quick spreadsheet estimated that shopping at national chains buying mass marketing goods with your credit card causes $215 out of every $1,000 (21.5%) to flow into the pockets of the wealthiest people.

But whether that actual number is 5%, 10%, or 30%, there’s something interesting that happens when we consider how money moves through the economy.

Recall that the money we spend does benefit the people who sell, make, and support goods. When I spend $1,000, the percent not taken by the wealthy goes into the pockets of other people in the 99%. Those people also spend that money, and some portion of what they spend goes to the 99%, and some goes to the 1%.

The economy depends on money recirculating. In fact, the very idea behind an economic stimulus (part of overall monetary policy) such as lowering taxes or offering a tax rebate is not just that you’ll spend money, but that the money you spend is earned by other people who then turn around and spend it again, and so forth.

Where we run into a problem is when the wealthy skim off a percentage of all transactions, as we see that they do through card processing fees and the ownership of retailers and manufacturers.

Consider the following chart. Each row assumes a different percentage that the 99% retain each time money is spent, ranging from 75% to 99.9%. In the first row, we see that the first time money is spent, $750 flows to other people in the 99%, while $250 flows to the wealthy. By the time that money has recirculated five times, only $237 is left for the 99%, while the wealthy now have most of it.

Compare this with the bottom row, in which we assume that through making very educating spending decisions, we’re almost always able to support small, local businesses and individuals. In that case, by the time the money has recirculated five times, an amazing $995 is still within the 99%, and only $5 has gone to the wealthiest 1%.

| Amount left for the 99% | ||||||

| Starting Amount | Percent Spent with the 99% | Round 1 | Round 2 | Round 3 | Round 4 | Round 5 |

| $1,000 | 75% | $750 | $563 | $422 | $316 | $237 |

| 80% | $800 | $640 | $512 | $410 | $328 | |

| 85% | $850 | $723 | $614 | $522 | $444 | |

| 90% | $900 | $810 | $729 | $656 | $590 | |

| 95% | $950 | $903 | $857 | $815 | $774 | |

| 99% | $990 | $980 | $970 | $961 | $951 | |

| 99.90% | $999 | $998 | $997 | $996 | $995 | |